45l tax credit extension 2022

Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000 federal tax. Available for all years of postsecondary.

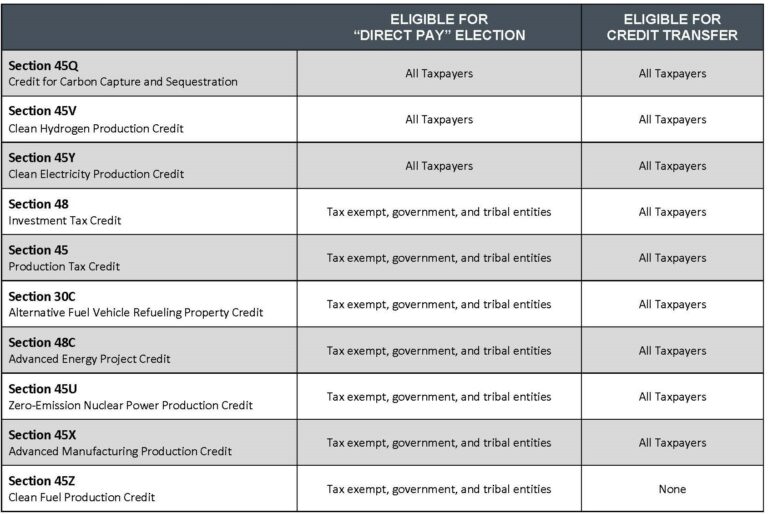

Inflation Reduction Act Expands Energy Efficiency Tax Incentives

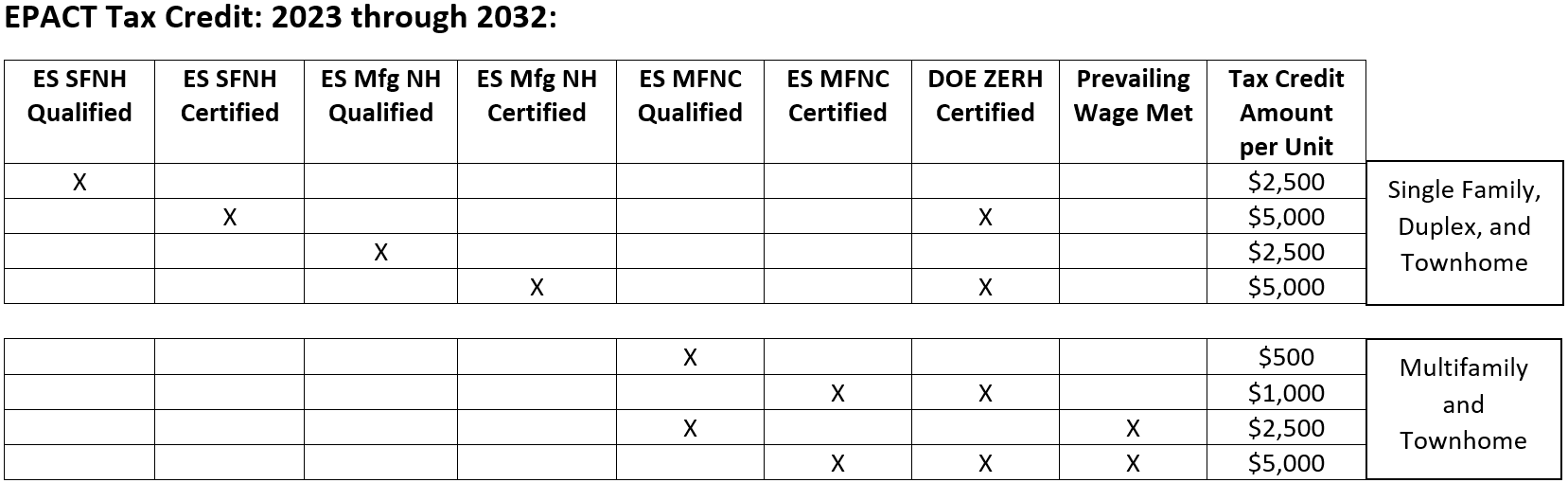

The key 45L provisions of the law include.

. The legislation is expected to pass and wil. The lifetime learning credit is. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient.

Code 45L - New energy efficient home credit. This includes provisions of a bill that includes some of the most significant climate change. This means no BBB Act Build Back Better Act.

Developers that build or substantially renovate qualifying residential dwelling units that meet certain energy-saving standards may be eligible for a one-time 2000 per-unit credit. The 45L tax credit for builders is included in the Inflation Reduction Act of 2022 which will be voted on soon. What the Expanded Tax Credit Means for Builders.

Arkansas Builder received 20000 in credits for homes sold in 2020 and 2021. Texas Home Builder had 8000 total credits for homes sold from 2019 to 2021. The existing language for the 45L tax credit was.

The Inflation Reduction Act of 2022 is an updated version of the 45L Tax Credit. August 18 2022. The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes.

Visitation was held on Wednesday September 28th 2022. On July 27 the United States Senate announced the Inflation Reduction Act of 2022 which includes 36975 billion in Energy Security and Climate Change programs over. Acquired by a person from such eligible contractor for use as a residence during the taxable year.

Congress has wrapped its 2021 session and will not resume again until January when the next Congressional session opens. Developer who owned and. The proposal would increase the section 45L tax credit for an energy efficient home from 2000 to 2500 and extend the tax credit five.

This New White 2022 Chevrolet Colorado is for sale at Chevrolet 112 near Huntington. The average price per pound is 138 for consumers according to the most recent statistics from the US. Featuring a 25L 4 cyl and Extended Cab Pickup - Standard Bed body style.

Leave a sympathy message to the family in the guestbook on this memorial page of Frank Bernacki to show support. 45L is a federal tax credit for energy efficient new homes. Extension of the tax credit for ten years with a new expiration date of December 31 2032.

On Tuesday August 16 2022 President Biden signed the Inflation Reduction Act which significantly impacted and expanded. Originally having expired at the end of 2021 45L tax credits have been retroactively extended for 2022 through the end of 2032 creating significant benefits for. Worth a maximum benefit of up to 2000 per tax return per year no matter how many students qualify.

That means a 10- or 14-pound pumpkin. The 45L Credit is set to expire at the end of 2021. The new energy efficient home credit as defined by Internal Revenue Code IRC Section 45L was extended increased and modified under the Inflation.

Inflation Reduction Act May Increase And Broaden Energy Tax Incentives Cpa Practice Advisor

Inflation Reduction Act Of 2022 Makes Major Changes To 179d And 45l Energy Tax Incentives Walker Reid Strategies

Revised Build Back Better Legislation Could Extend And Modify The 45l Tax Credit Ics Tax Llc

What S In The 2022 Inflation Reduction Act Laporte

Section 45l Tax Credit Rewards Developers Of Energy Efficient Homes Our Insights Plante Moran

The 45l Tax Credit Is Expiring Again Cheers 45l

Inflation Reduction Act S Impact On Tax Credits Deductions Stg

Take Advantage Of The 45l Credit For Residential Buildings Through 2021 And Let S Hope It Gets Extended For 2022 And Beyond Cla Cliftonlarsonallen

Bill Introduced In Senate Will Extend 45l Energy Efficient Home Tax Credit For 10 Years Warner Robinson Llc

Energytaxcredits Twitter Search Twitter

Section 45l Tax Credit Rewards Developers Of Energy Efficient Homes Our Insights Plante Moran

The Section 45l Credit Was Just Extended And That S Good News Here S Why Marcum Llp Accountants And Advisors

One Year Extension Through 2021 For Energy Efficient Home Section 45l Tax Credit Warner Robinson Llc

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Capstan Tax Strategies

Eia Annual Energy Outlook 2022 U S Energy Information Administration Eia

Builder Resources Ruth Company Llc Lathrop

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Energysmart Institute How Does The Inflation Reduction Act Impact The 45l Energy Efficiency Tax Credit For New Construction Of Homes And Apartments

45l A Key Strategy To Consider Before 9 15 Capstan Tax Strategies